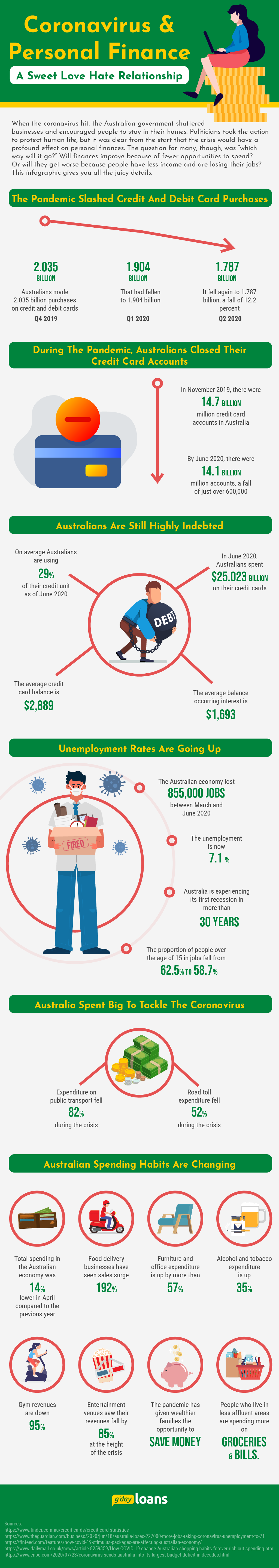

Coronavirus and Personal Finance - A Sweet Love Hate Relationship

When the coronavirus hit, the Australian government shuttered businesses and encouraged people to stay in their homes. Politicians took the action to protect human life, but it was clear from the start that the crisis would have a profound effect on personal finances. The question for many, though, was “which way will it go?” Will finances improve because of fewer opportunities to spend? Or will they get worse because people have less income and are losing their jobs? This infographic gives you all the juicy details.

The Pandemic Slashed Credit And Debit Card Purchases

- In Q4 2019, Australians made 2.035 billion purchases on credit and debit cards

- By Q1 2020 that had fallen to 1.904 billion

- By Q2 2020, it fell again to 1.787 billion, a fall of 12.2 percent

During The Pandemic, Australians Closed Their Credit Card Accounts

- In November 2019, there were 14.7 million credit card accounts in Australia

- By June 2020, there were 14.1 million accounts, a fall of just over 600,000

Australians Are Still Highly Indebted

- On average Australians are using 29 percent of their credit unit as of June 2020

- The average credit card balance is $2,889

- The average balance occurring interest is $1,693

- In June 2020, Australians spent $25.023 billion on their credit cards

Unemployment Rates Are Going Up

- The Australian economy lost 855,000 jobs between March and June 2020

- The unemployment is now 7.1 percent

- Australia is experiencing its first recession in more than 30 years

- The proportion of people over the age of 15 in jobs fell from 62.5% to 58.7%

Australia Spent Big To Tackle The Coronavris

- The Australian government announced it would spend $184 billion to tackle the coronavirus

- Australia is currently experiencing its largest budget deficit since WWII

Australians Are Saving On Travel Costs

- Expenditure on public transport fell 82 percent during the crisis

- Road toll expenditure fell 52 percent during the crisis

Australian Spending Habits Are Changing

- Total spending in the Australian economy was 14 percent lower in April compared to the previous year

- Food delivery businesses have seen sales surge 192 percent

- Furniture and office expenditure is up by more than 57 percent

- Alcohol and tobacco expenditure is up 35 percent

- Gym revenues are down 95 percent

- Entertainment venues saw their revenues fall by 85 percent at the height of the crisis

- The pandemic has given wealthier families the opportunity to save money

- People who live in less affluent areas are spending more on groceries and bills.

Sources:

https://www.finder.com.au/credit-cards/credit-card-statistics

https://finfeed.com/features/how-covid-19-stimulus-packages-are-affecting-australian-economy/

Warning: Do you really need a loan today?*

It can be expensive to borrow small amounts of money and borrowing may not solve your money problems

Check your options before you borrow:

- For information about other options for managing bills and debts, ring 1800 007 007 from anywhere in Australia to talk to a free and Independent financial counsellor

- Talk to your electricity, gas, phone or water provider to see if you can work out a payment plan

- If you are on government benefits, ask if you can receive an advance from Centrelink: humanservices.gov.au/advancepayments

- The Government’s MoneySmart website shows you how small amount loans work and suggests other options that may help you.

* This statement is an Australian Government requirement under the National Consumer Credit Protection Act 2009.

The Government’s MoneySmart website shows you how small amount loans work and suggests other options that may help you.

* This statement is an Australian Government requirement under the National Consumer Credit Protection Act 2009.